You Plan Top-Down

We process bottom-up to show you the big picture:

find risk & return for thousands of tickers to see the efficient frontier,

enumerate past market corrections to see dive and bounce heights,

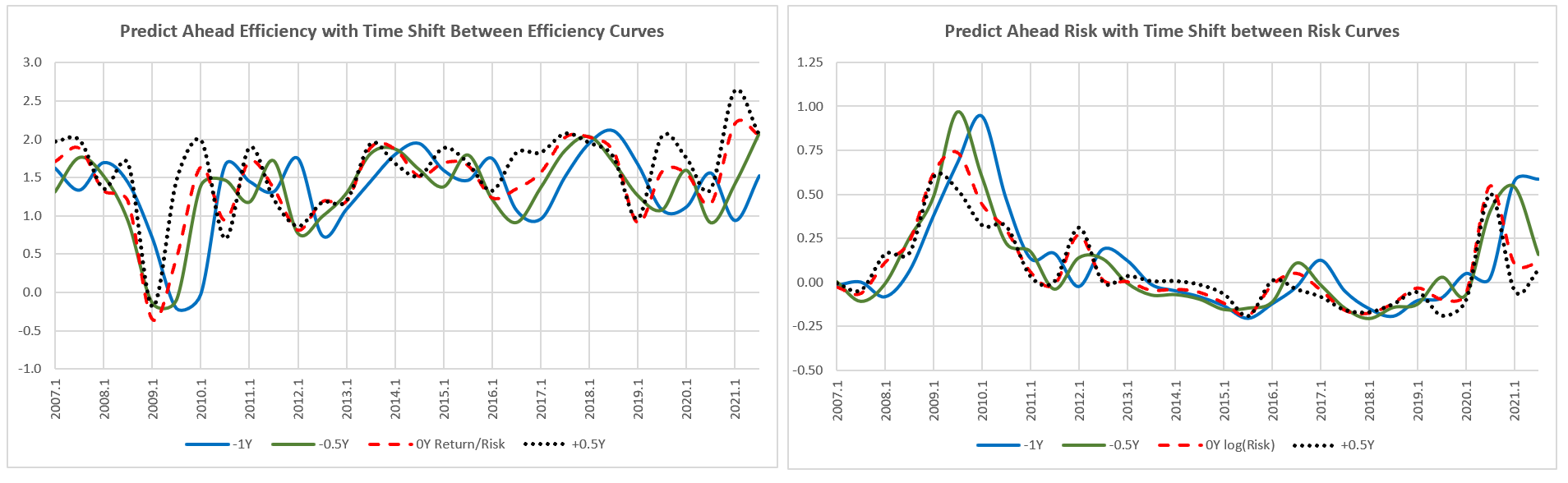

find historical curves over 15 years to see period and phase of large swings,

select + allocate to 50-best tickers to see portfolio return,

simulate buy-and-hold to see impact of holding > 1-2 years.

You plan top-down from that big picture:

a holding interval to drive portfolio return, risk, efficiency.

a continuous rotation to remove/add less/more efficient tickers.

a diversification that maximizes 0.75 * bounce beta - dive beta, to plan for market corrections.

Your portfolio will converge to the optimum combination on the Efficient Frontier over months.

Assuming you let the law of large numbers works its magic of cancelling out random prediction errors, you will have a predictable total return and efficiency that is the largest median value, given all market conditions.

The biggest causes of poor return and efficiency are:

a. Not investing on the Efficient Frontier, or holding on to your cherished tickers when they are clearly not efficient.

b. Market conditions are changing too fast, like a big crash or a sharp U-turn at the bottom or top of the market.

c. Buy high when market is hot, and sell low when market is depressed.

You can solve 4.a with frequent rotations, by re-program 15 orders, to buy/sell 5 best/worst tickers, amount * 2^n, limit * 0.5 * n, to hit at exponentially smaller prob = (.31, .16, .08).

You can solve 4.b by saving cash to auto buy at market dips, or by cashing out some at market tops, using exponential limit orders as above.

Solving 4.c is hard, because we are humans, not machines. But may be we can use a personal robo- adviser that is just software that tirelessly searches all scenarios to tell us to be patient and not buy high, to calm us so we not sell low. By showing the log(price) and gain curve, or the efficient & swing frontiers, we can at least confirm we are doing better than SPY or the market.