Check Under the Hood

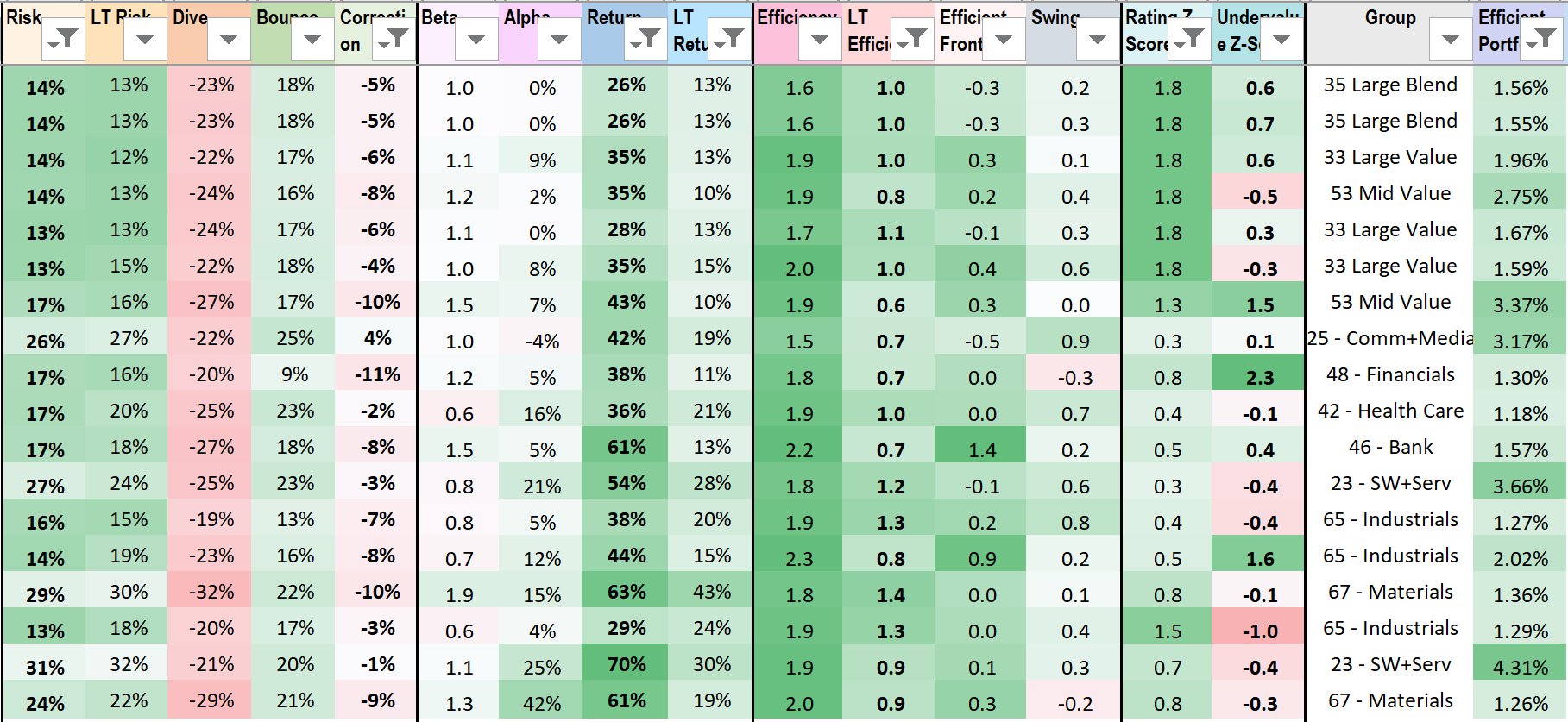

Portfolio is where we display the mean values of the portfolio’s columns, weighted by the allocation to the 50-best tickers on the efficient or swing frontier.

Your portfolio will be a unique combination of cash = (0, 0) and allocations to these most efficient tickers, so that your portfolio is moving towards the efficient frontier. No one-size-fits-all formula, instead you custom to your risk tolerance. The more you rotate towards the most efficient or the largest swing tickers, the higher the efficiency your portfolio will have.

Market Correction tabulates the dive & bounce heights of past market corrections, to give you an idea which type.group.sector is a better hedge: i.e. smaller dive and larger bounce than others. The tickers are grouped by type (ETF, stock), then by similar group-sector for similar (predictability, frequency), swinging between growths and values. A rough allocation by group will allow automatic blend of value-growth tickers, which rotates between themselves at similar frequency.

Local & Global Trend shows the prediction accuracy through the time shift between efficient frontier curves, and the prediction non-precision through the amplitude of the oscillations. With full data measurements, we see time shift = 0.5Y and very little oscillation. With prediction farther into the future, +1Y, we see smaller time shift and larger oscillation amplitude.

We monitor and display the systematic and random error in predicting future risk & return, every time we run a new version of the code, on new price & volume data. Our goal is simple: Reduce Prediction Error over time, so you always have a more accurate prediction to make your investment decisions. However, be aware that this prediction is based on past data, assuming local trend using a straight line will hold within weeks, or global trend using a sine wave will hold within months compared to their period = 2 +/- 1 year. No one can predict future events, which will impact future data, so you must diversify to handle all future scenarios.