How To Drop Less in a Crash

Market always rotates away from growth tech with no profit before a crash. The most efficient tickers are single stocks of companies that have real profit, free cash flow, little debt, so will drop less like bond.

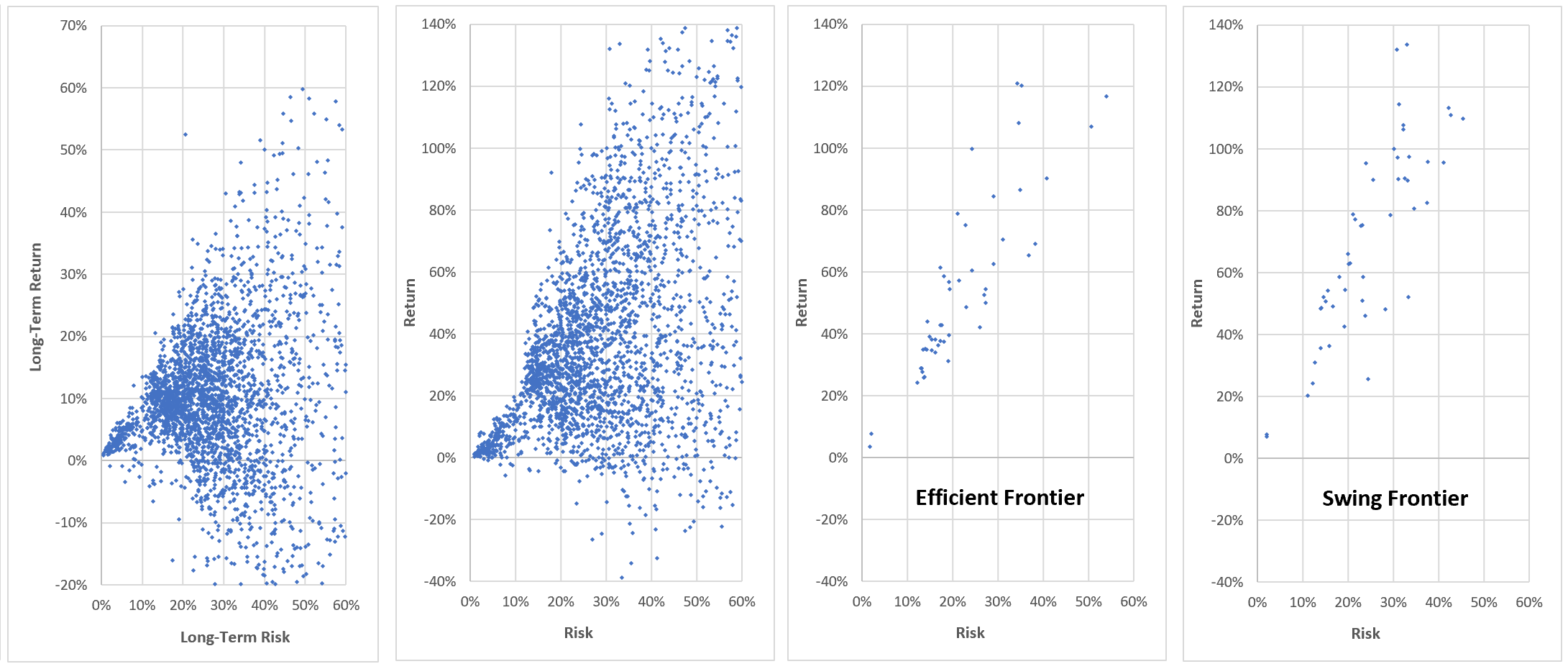

Reduce your portfolio risk by simply moving towards cash=(0, 0). Raise more cash so you can buy efficient tickers at -10%, -20% dips. It is very hard to time and buy at market bottoms, when fear dominates. But it is very easy to program ahead limit orders to buy on the way down, and sell on the way up.

View historical curves: Risk, Return, Efficiency, for recent -5 years. Compare to 2008 (-12Y) to see relative magnitude in red or green. View all Dive, Bounce heights, including 2008. There are so many tickers and sectors that do well.

Choose large crash resistance = 0.75 * Bounce - Dive, for smaller Dive Beta to drop less, or larger Bounce Beta to jump more. Invest in many of them, to get a more predictable total return.