How To Buy Low and Sell High

To buy low, you must buy tickers that are undervalued, i.e. have better fundamentals now, or have better growth rates so their fundamentals will be better next year.

Sort Undervalue-Z, to pick tickers that are more undervalued than others, so the price you buy will be low, and will drop less after you buy, and will have a lot of room to grow as these tickers revert to their mean.

Compare with Fundamentals by opening 'Rating-Z' to check 5 yields. How much each $ you invest will give you in: debt, earnings, cash flow, sales, book value? This is fundamental value now, from the latest quarterly report, downloaded from our brokerage website.

On purpose, we always convert to z-score, so peak=white for most frequent scenario, shade of red-green if worse-better than most other tickers. This gradient color is very helpful if you sort by Group last, to compare similar tickers together.

Compare with Growth Estimates from analysts for the fundamental value of next year.

They are consensus predictions from analysts, based on past history of fundamentals, different from technical analysis based on past price & volume series.

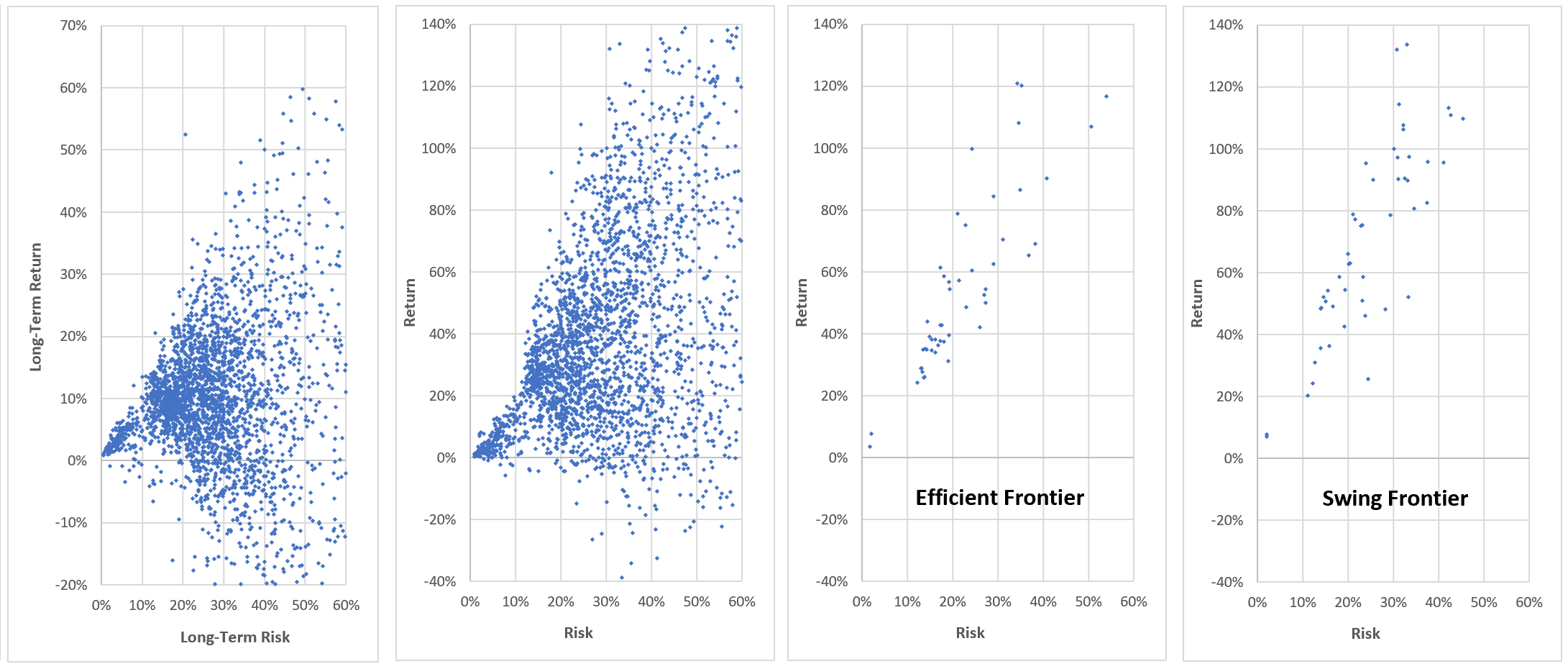

Swings in the Return(time) curve can be noisy, unreliable. The log(Price)(time) curve has even more big jumps that lure you in and sharp dips that scare out out. Use the Return(time) curve to recognize a long-term growth rate, which is the slope of the axis about which log(Price) curve is a repeatable sine wave with a constant period. Use phase to buy at [Slow-Lo, Fast-Up] and sell at [Slow-Hi, Fast Dn] to invest on the swing up and avoid the swing down.