How To Invest With the Market

Simplest is to invest in QQQ, XLK, for more tech & growth than SPY (market), DIA (value), and save cash to buy at -10% dips. Choose blend ETFs to average between growths and values, complementary sector ETFs to average their periodic swings, smart beta ETFs to switch to high/small beta stocks for up/down market, all for max average future efficiency. Or invest in active ETFs like ARKK and let the expert analysts select, rotate the innovations for you.

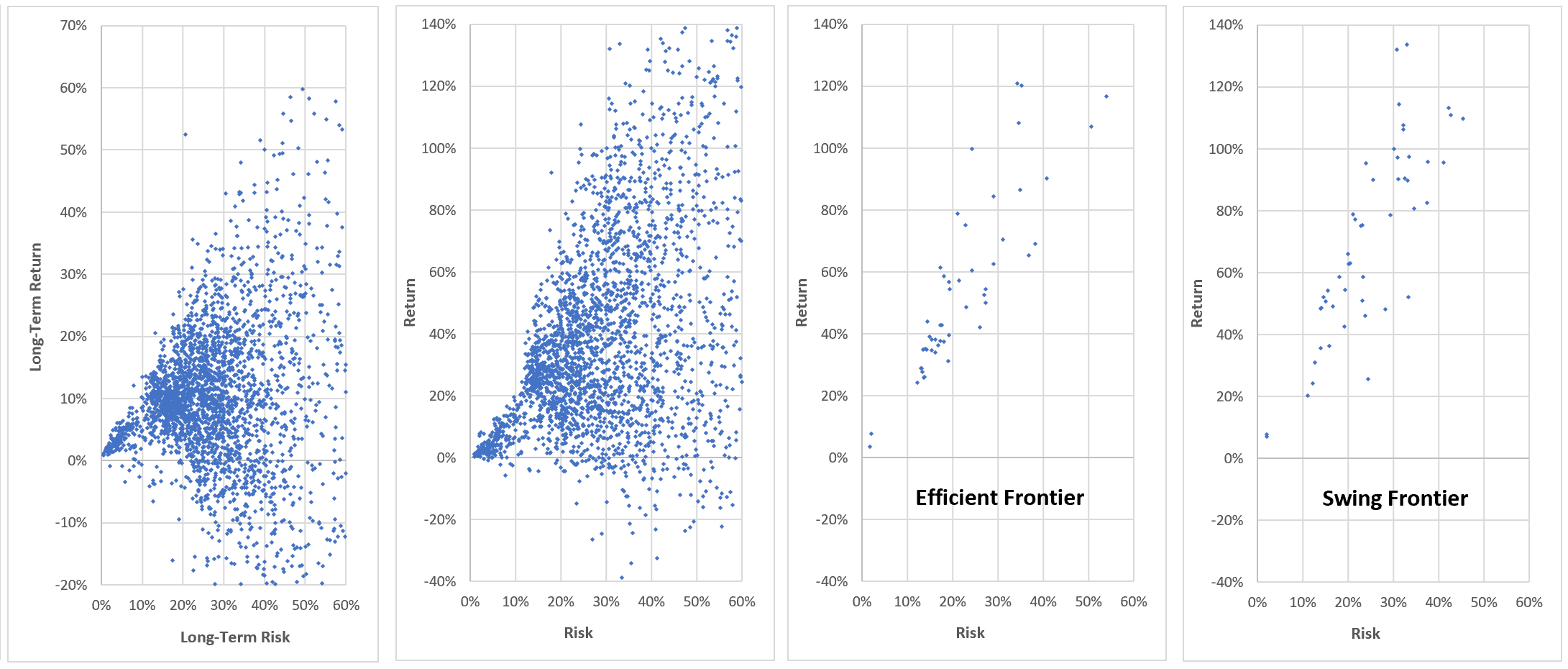

2. You must predict ahead of the market by your holding interval, hoping to buy low now then sell high later, to earn the expected return, so check the phase of their sine waves to get in/out. Invest with efficiency, not with stock tips, with fundamentals and analyst ratings, always checking (risk, return) point relative to the future efficient frontier.

3. You must grasp why compounding over time means log(Price) is a straight line over the years. You must skip the zigzags that repeat at many scales in clusters like fractals, or wavelets with too high frequency, plus random walk, all too fast for buy-and-hold investors. If log(Price) is straight line, then the slope or gain over the years must be a constant growth rate. Notice the sine wave about this constant growth rate, to capture periodic mean reversions between bull & bear phases.

4. The straight line model fits well tickers that are bond or fixed income. The sine wave model fits well equity tickers with period ~= 2Y, smaller 1.3Y for newer small caps, larger 3Y for older large caps. You must spend time to select, research the most efficient tickers, then program buy/sell orders with limit, so that your portfolio + cash are always on the Efficient Frontier.