Market Crash of 2020

Before the market crash of 3/2020, there were so many small and mid cap stocks doing extremely well on the efficient frontier. After the crash, most of them were deep in the hole, replaced by low-growth staples, health care, bio-tech stocks that help fight the pandemic, as the whole world contracted and fought the virus. Growth stocks eventually came back 3-6 months later, but some of them could not survive because of high debt and low cash flow… This was a sudden rotation that caught everyone in a big tsunami wave... We were lucky we saw some of this rotation happening a year earlier, so we had more diversification, more allocation to cash, and this softened the blow. There will be many more and deeper dives in the years ahead, hopefully many soft landings instead of a big and scary crash that wipes out our savings.

Market correction or crash creates very large systematic shocks. Stocks, equity with large positive correlation beta to market, will see their prices reset to lower levels, if their future growths have vanished. The big reset will have many drops and bounces over weeks & months, as the market predicts based on the new fundamentals.

You must plan ahead to save cash to buy the dips, have enough fixed income to live through bear markets, as well as invest in equity to capture the robust gain in bull markets, because your investment horizon is years.

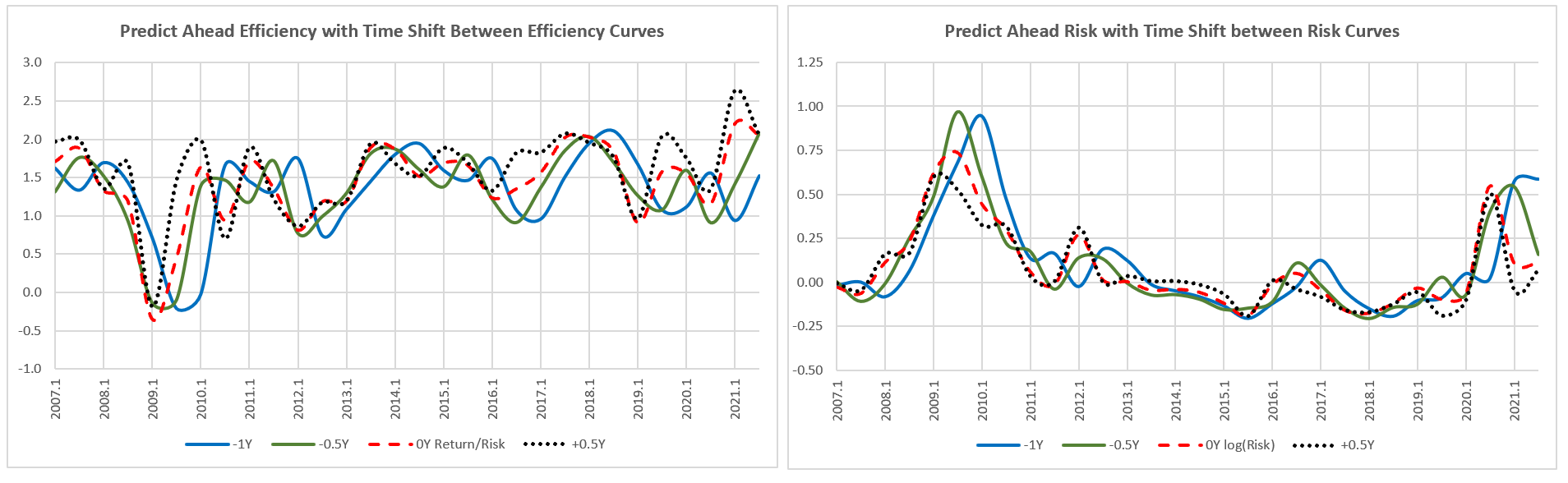

A sudden change in fundamentals creates large parabolic drops or jumps, to the next price levels dictated by the new fundamentals. These large step changes in price are impossible to predict, not like the gradual change in growth estimates, analyst ratings, undervalue scores, based on slowly changing employment or economic data. Check for smaller time shift in the efficiency, risk and return curves, especially when the market dives fast.

Sudden adverse events, that only last a few days or weeks, are counted as extreme drops, and will be added to higher total risk, resulting in lower efficiency, a point farther from the efficient frontier. This will exclude many high growth techs, that drop a lot then swing up from their bottoms, rare but deep value, with limited downside risk and large gain potential. Searching for these deep values on the swing frontier, while skipping dead beats, is much harder than investing on the efficient frontier.

You must research on the fundamentals, as they last longer than the technicals, to buy and hold a long time. It would be nice we have powerful prediction, search, optimization to build a robo-adviser to calm you, to not sell when the market dives, and brake you, to not buy when the market is overheating.