Improve Accuracy

Let’s have a technical forum to discuss: risk, return, efficiency, swing, fundamentals, allocation. Your observations will guide us to enhance our formulas, our algorithms, resulting in more accurate numbers in spreadsheet, more relevant suggestions to the long-term investors.

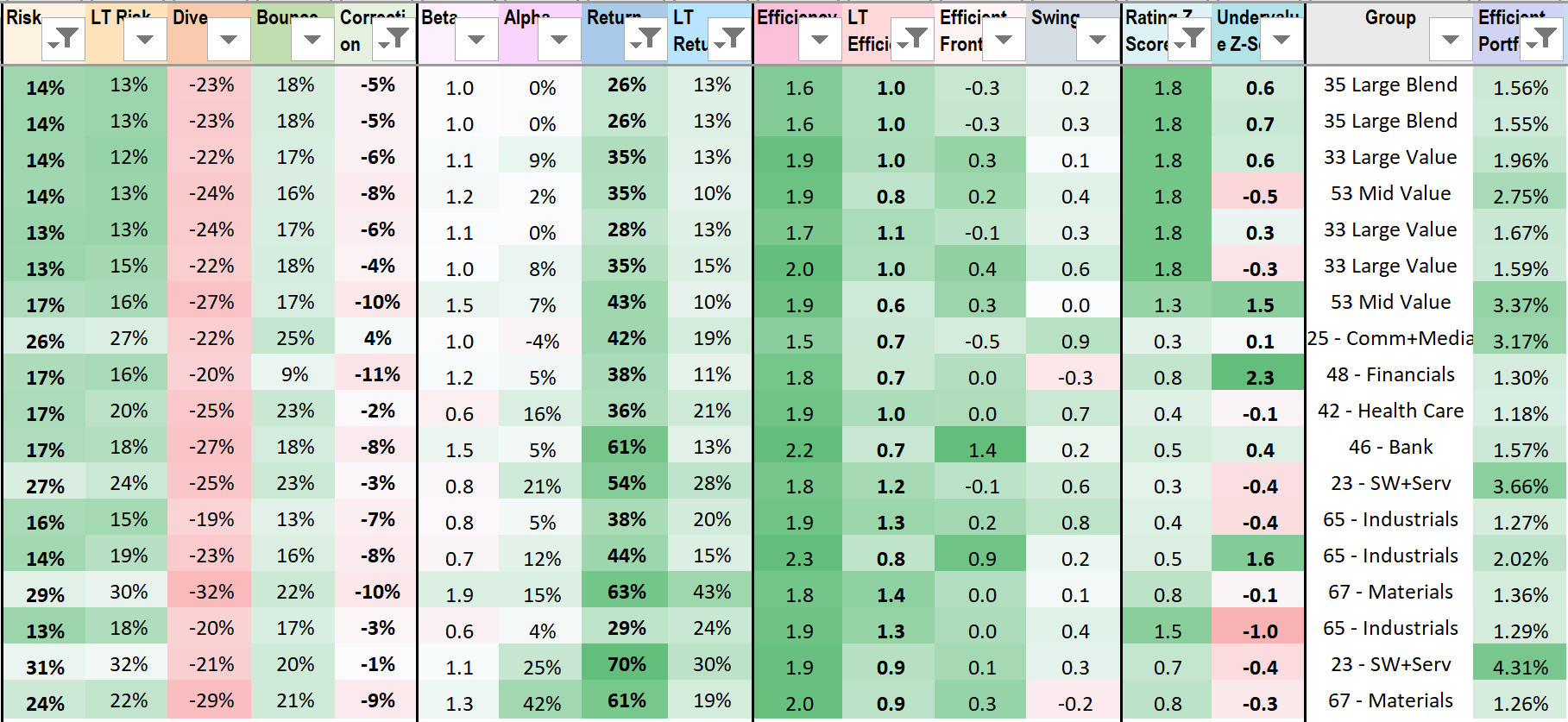

Risk must capture the extreme drops in prices that make retirees and novice investors most scared. These extreme drops happen every year with similar probability. If we sort tickers in the same group by risk, the sorting order must correlate to our perception of more or less risk between these tickers.

Return must measure past gains, and predict future gains in prices, robust to trading zigzags, and to short-lived drops or jumps. We need a robust measure of most-likely return per year, in both good times and bad, to select tickers with maximum future return and minimum future risk.

Efficiency is the ratio of total return to total risk, so we can maximize return while we minimize risk at the same time. If risk is measured as standard deviation from extreme drops, then efficiency is like a z-score, describing the cumulative total return normalized by standard deviation of the distribution of return values per year.

Swing is z-score of a change in efficiency, measured through a decrease in risk and an increase in return, compared to market. Increase in return is an acceleration in log(Price), a 2nd-order derivative, so this is a sharp curvature in log(Price). If this sharp curvature is accompanied by a decrease in risk, then it could be a sharp turn-around voted by the market.

Fundamentals are the many yield ratios extracted from the latest quarterly report, summarized by the average rating from all analysts, or by the undervalue score that takes into account both the current earnings for this year and the future consensus growth estimates for next year.

Allocation is the percentage you allocate to each selected ticker, so that your portfolio has maximum future efficiency. We search for a buy-and-hold allocation that is semi optimum, by diversifying over 50-best tickers that are on the future efficient or swing frontiers.