Frequently Asked Questions

Why not just output 1-2-4 best tickers? A spreadsheet of 50-3000 rows/tickers is too many, too much work. Why not just assign 1 label: Buy, Hold, Sell?

We hope you are very scared of losing your savings, so you rather put in the time to compare, using all the information you can find, then match to your unique situation, to find your best tickers to invest in. We strongly believe you must do your own research, as human brain is much better than machine at this last stage of ticker selection & allocation.

Why invest in 10-20 tickers on the efficient and swing frontier? Can 5 be enough? Can I buy and hold these tickers forever: 1-2 years?

We hope you research deep and exhaustive enough to find the few gems and hold them forever. But, if your research reveals better investments over time, then why not invest in more tickers?

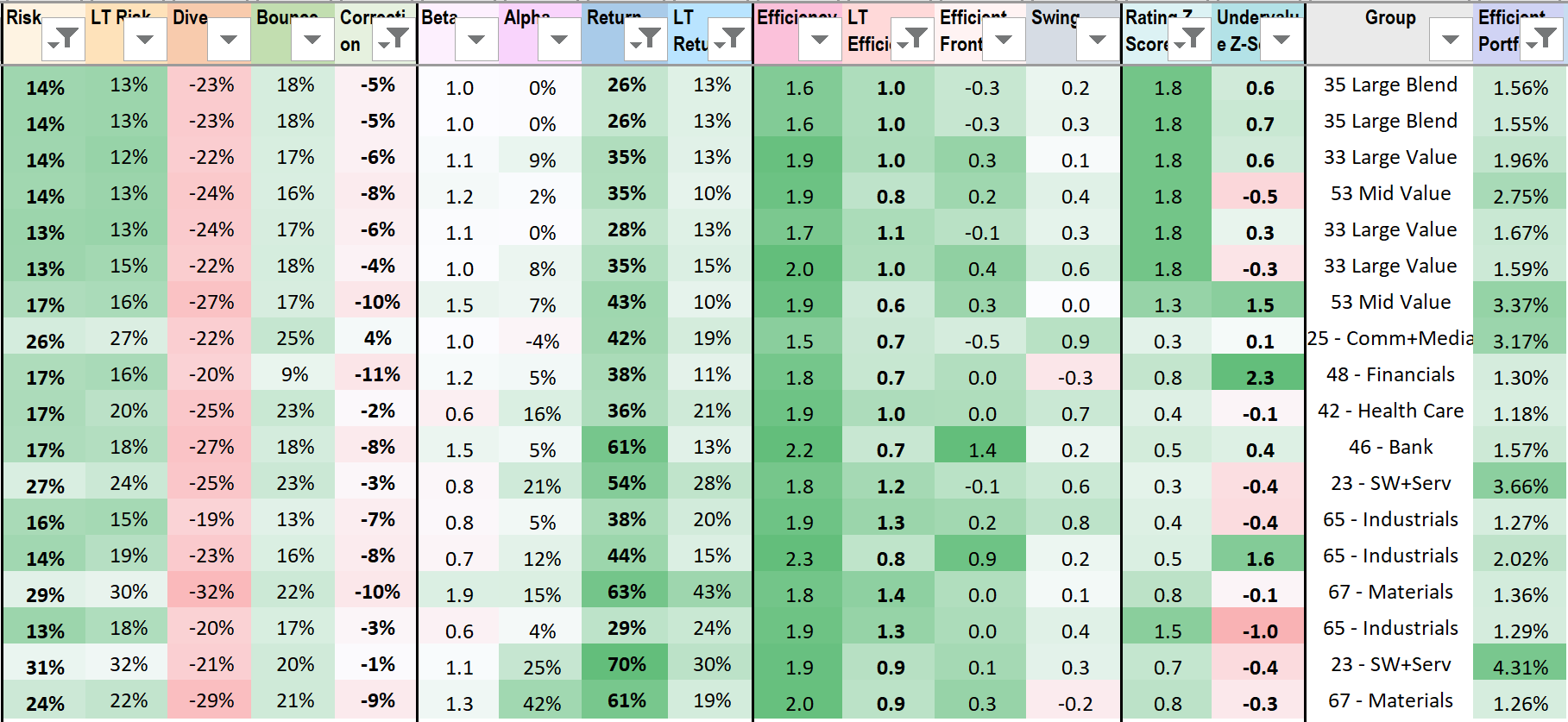

You invest in many tickers, all of them on the efficient frontier, so your portfolio will be on the efficient frontier too. No averaging of the best gains with the worst gains. From the spreadsheet, you can find efficient and swing tickers that are more predictable than others, where return(time) fits well to a straight line, or to a sine wave with a large period, so you can buy and hold for many years.

Can you predict the up/down market, when a crash will happen?

We hope you plan for frequent market corrections, then for a rare but big market crash like in 2020 or 2008. No one can predict when a big crash will happen next. But all the investors already plan ahead in their allocations, which reflect their predictions, and dictate which tickers move to the efficient frontier.

So, why don't you plan and invest in tickers of next year efficient and swing frontier?

Resources to help you invest better?

Definition at Investopedia, discussion at Seeking Alpha.

Market trend at MarketWatch, Mauldin Economics, graph at Stock Charts.

News, data from quarterly reports at Yahoo Finance, Bloomberg, WSJ.

Screen, trade at brokerage: Fidelity, TD Ameritrade, Schwab, E*Trade.

Feature maps at FinViz, portfolios at Validea, Portfolio 123.

Stock tips at many places, but check risk & fundamentals, not just gains.

Symbols, fundamentals, analyst ratings are downloaded from Fidelity.

Price & volume series are downloaded from Alpha Vantage.

Libraries in Data Science, price prediction with Machine Learning.

More questions?

Post your question and discuss at our Reddit forum.