How To Set Limit Orders

Always buy lower than current price, at Price - Limit. Always sell higher than current price, at Price + Limit. Your order will hit in 1-2-4 weeks. No fear of missing out.

Program 2-4 exponential orders instead of timing 1 big one and miss it. Buy/Sell 2^n larger amount * (0.5, 1, 2, 4), to be triggered at 1/2^n smaller probability = (0.31, 0.16, 0.08, 0.03), by using limit orders with wider Limit *(0.5, 1, 1.5, 2), to automatically buy/sell more if price swings in your favor.

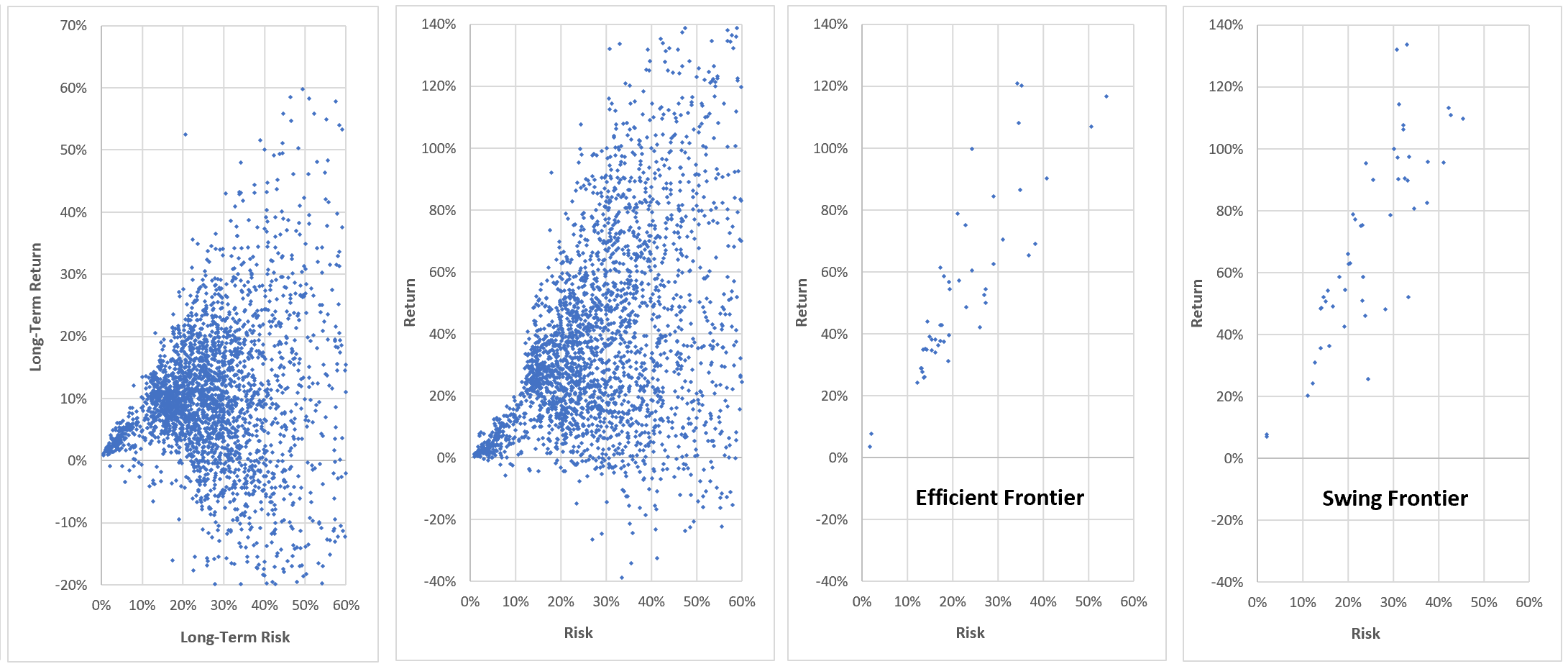

Never buy when tickers are hot, wait for mean reversion. Buy more when phase is near Slow-Lo, before Fast-Up. Sell more when phase is near Slow-Hi, before Fast-Dn, to profit from the big swing at optimal phase, lasting 2 months if period is 2 years.

Never sell when the market crashes. Wait for market to bounce back 50%-75% before you sell. Instead, use your cash to buy on sale, your list of most efficient tickers. Always research ahead, then program your buy/sell orders every weekend.