Minimize Biases

Our scale is months to years for buy-and-hold investors. Tickers must have a good future and long-term efficiency to be detected on the efficient or swing frontiers. Our hypothesis is that there are so many choices on this efficient or swing frontier, that you can choose a few of them, research on their fundamentals, believe in their future, management team and business moat, then invest on them for the long-term to get the expected average portfolio efficiency. We show you what data processing will reveal if you compare tickers using both technical and fundamental data, now and in the past. We can not tell you what will happen 1-2 years from now. This is for you to research to see if the company you invest in has a long term growth plan, a product pipeline, and is agile enough to deal with all market conditions.

Our prediction errors are random, non systematic, so will average to 0, if you diversify over many tickers, sectors, regions. This is why you must invest in 10-20 tickers, rotate them every week or month, so they are always near the efficient frontier, to get an expected larger return at a smaller risk, on average every year, in good times & bad.

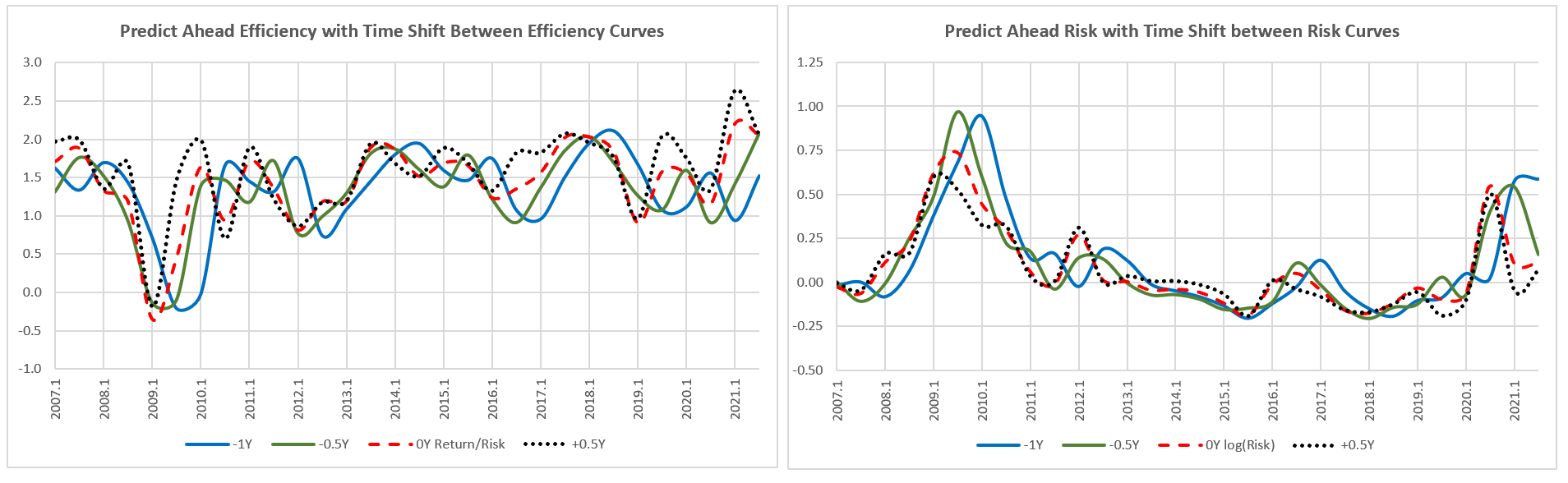

A bias in the training examples leading to over-fitting to a training set, a wrong model in the code leading to poor trend extrapolation, or a history too short to correctly estimate long-term growth rate & period, or a one-size-fits-all recommendation that drives all our readers to buy/sell the same stock tips, … these biases can induce large systematic errors in gain prediction, leading to poor future returns. Our job is to measure and make sure that gain prediction errors always converge fast to 0.

Our exhaustive testing, combined with your careful review and discussion, will help us detect and remove these biases, until they become negligible. We will list all the biases here, as soon as we discover them. Together, we find ways to solve the biases, or work around them.

Be aware of investor biases, as our brain have cognitive biases, so train yourself to recognize these biases and devise a system to avoid the roller coaster on the right.

We pledge to improve formulas and algorithms to minimize systematic errors. We will give no stock tips, only data-driven suggestions based on your current portfolios and the future efficient frontier, so that millions of investors can custom their selections and allocations differently. We will never distort the market and mistakenly lead you to buy high and sell low. We believe in the law of large numbers, in equal access to data and technology, to let all of us ride the big market trends.